St. Joseph Crop Insurance Disputes Attorney

Skilled Crop Insurance Dispute Attorneys in St. Joseph, Missouri

We represent farmers across the United States against insurance companies and the federal government. We are aggressive and our fees are affordable. Fighting denied or disputed crop insurance claims is complex business. The insurance policies are long, ambiguous, and confusing. To make things worse, the federal government has a heavy hand in the process. So don’t fight alone. Hire a St. Joseph crop insurance disputes attorney.

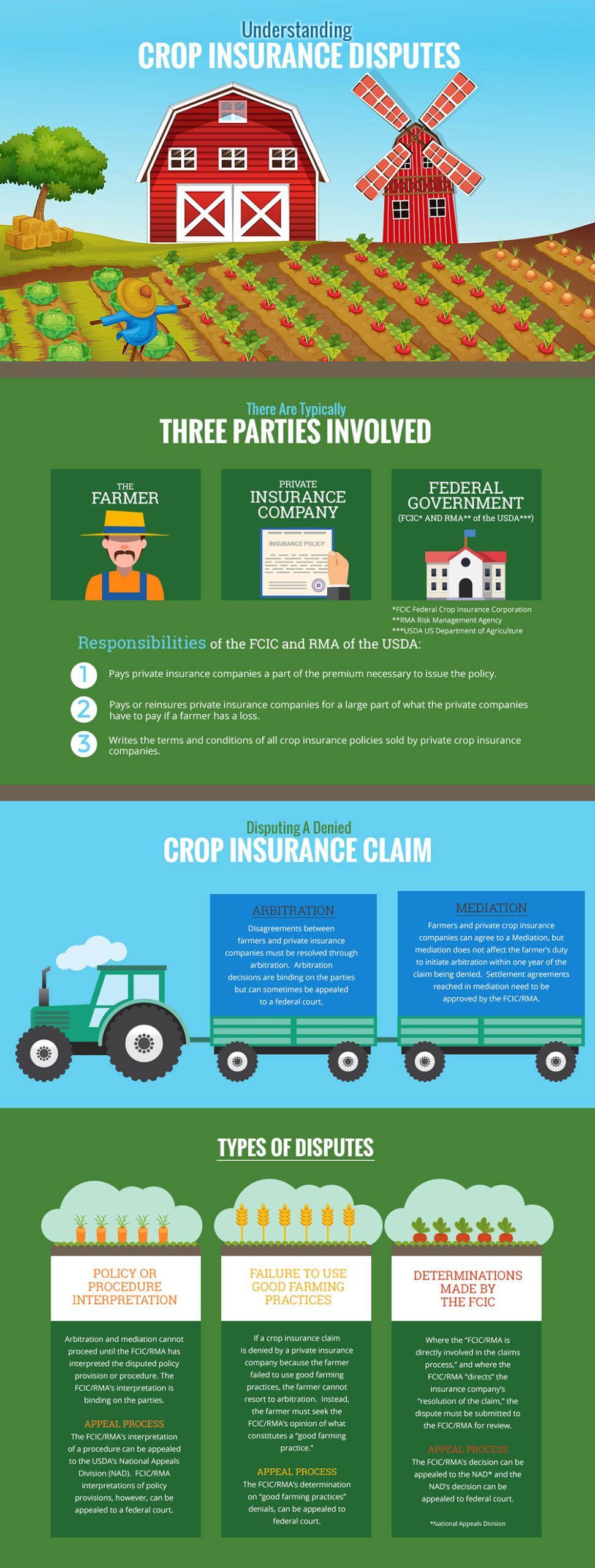

Below is an infographic we produced to give you a visual understanding of crop insurance law and crop insurance disputes.

An experienced crop insurance lawyer can fight for you to get the claim resolution you deserve. A denied crop insurance claim can be devastating to a farm operation. You paid for the protection. Don’t let them take that away from you.

Crop Insurance Arbitration and Mediation

We can help farmers with the arbitration or mediation of any crop insurance dispute. Some of the more common disputes are:

- An insurance company’s wrongful interpretation of the insurance policy

- An insurance company’s erroneous application of the insurance policy to the farmer’s situation

- A denied claim based on an allegation that the farmer did not follow “good farming practices”

- An insurance company’s “lowball” adjustment of the claim

- A wrongful termination of coverage (based on an alleged non-payment of premium, misrepresentation and other grounds)

- An assertion that the insurance company has overpaid a claim and wants some of its money back

- A wrongful calculation of the premium charged for getting coverage

Crop Insurance Appeals

A St. Joseph crop insurance disputes attorney can also take up your case for purposes of appeal. Once the federal government makes a decision, that decision can often be appealed to federal court. The earlier we can get involved in the case, the more we can contribute to spotting and preserving legal issues that can give farmers an advantage in federal court. If those issues are not raised early in the process, it will likely be too late once the case reaches federal court. The court will see the issue as having been waived.

Insurance Agent Negligence

Another matter that sometimes comes up in connection with crop insurance disputes is the negligence of an insurance agent. If an insurance agent helps you secure coverage, they have a duty to exercise caution and professional expertise in making sure you have the right type and amount of coverage. If they fail to do that, they can be held liable under the laws of many states. In fact, insurance agents usually carry errors and omissions insurance for themselves so that their customers are protected in the event of an error or omission in the process of obtaining coverage. We look for the possibility that an agent error or omission has contributed to your loss when we evaluate your case and will let you know if that is something that needs to be pursued.

Misrepresentations About Coverage

Sometimes an insurance agent or insurance company representative will tell farmers they have certain insurance coverage when that is not true. Then, when the farmer submits a claim on their crop insurance policy, the claim is denied because it turns out the farmer did not have the coverage they were told they had. That doesn’t necessarily mean the agent or insurance company representative lied or tried to intentionally deceive the farmer; it may just mean they were careless in what they told the farmer. For instance, the insurance company representative may have represented to the farmer that they had certain coverage when they really didn’t have enough knowledge on the topic to know whether it was true. Fortunately, the law provides farmers with recourse in that situation. The agent or insurance company can be held liable for the farmer’s loss because of their negligent or intentional misrepresentation.

Contact a St. Joseph Crop Insurance Attorney We are here to help

Ben Creedy and the crop insurance lawyers at Taylor Siemens Elliott Creedy & Lyle P.C. have the experience and knowledge to help you with disputes over crop insurance claims. They can help with cases throughout the United States.

Crop insurance cases are handled on an affordable hourly fee basis and in some cases, a flat fee can be arranged. We don’t like getting big bills by surprise in our personal lives and business. Therefore, our practice is to avoid that for our clients. We will promptly evaluate your case and provide you with a budget so you can know what to anticipate. If something comes up that is outside that budget, we talk to you first and discuss what needs to be done and why it is necessary.

Contact us today for a free consultation to discuss your case. The longer you wait the harder it may be to win.